Over the past three years, more than 700 credit unions have merged with other credit unions.

Peer-to-Peer offers a number of ways of looking at and analyzing mergers:

- Create a merger scenario by combining two or more credit unions or banks

- Utilize the most recent List of Merged Credit Unions.

- Assess a potential merger by looking at the Merger Analysis Packet, which gives a snapshot of key ratios, financial position and performance, and important operational concerns

This page provides you with access and guidance on all three of the above.

What You Need: Decide which institutions you want to merge.

For example, you can merge two credit unions or two banks, but cannot combine banks and credit unions within a merger.

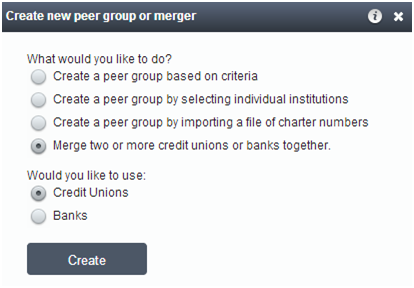

- Click ‘Comparison Set’ at the top and then ‘Create New’.

- Select the fourth option “Merge two or more credit unions or banks together”.

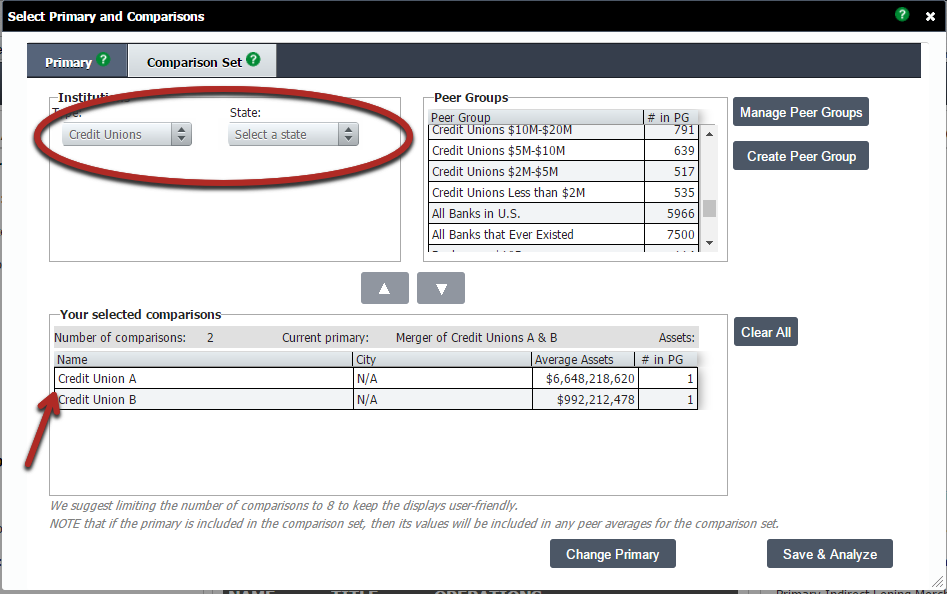

- Choose whether you want to merge credit unions or banks.

For this example we will merge two credit unions, so we can leave the default selection set to credit unions.

To start searching for institutions to merge, you can either use the state drop down, or simply type the credit union name into the search bar, and results will begin to populate in the Matches box below.

- To select an institution to include in your merger, single click on it and use the blue arrows to move it over to the Selected Institutions box, or double-click and it automatically pops over. If you made a mistake the same logic works to remove the institution.

- Once you have selected your institutions, click save, and give the merger a descriptive name.

- Next, decide if you would you like to add this merger to your comparison set, or save it for later.

Now you’ve built your merger! Move on to the section below called Using Your Merger.

Now we have created our merger, we have to take two more final steps to make sure Peer is properly set up to perform our analysis.

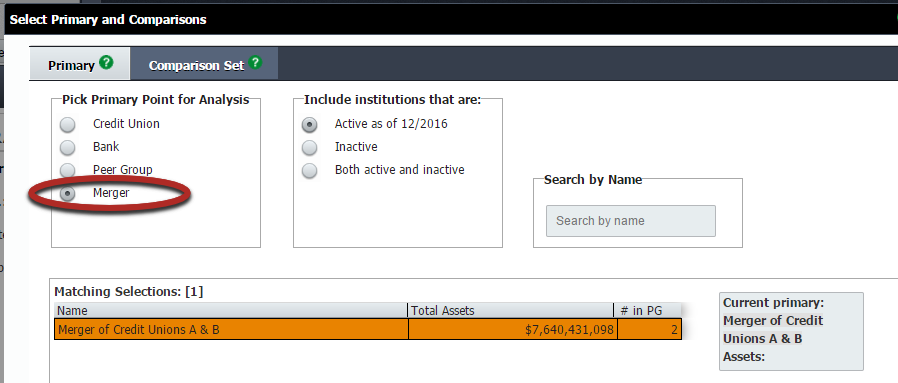

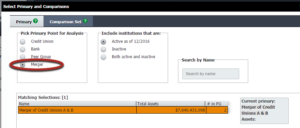

Step One: Set the new merged institution as your Primary.

- To do this, click on Primary in the upper-left corner.

- From the pop-up, select the merger option from the “Pick Primary Point of Analysis” list.

- Below this, the “matching selections” box will populate with any mergers you have created – just click on the merger you would like to use for your analysis and then you are ready for the final step.

Step Two: Add the Merged Institutions to the Comparison Set

To get the full picture of a merger’s impact, we need to include the two institutions which we merged so we can compare them to the combined entity.

- You can do this by clicking on the “Comparison Set” tab from the same pop-up window, and filter for credit unions by state.

- To add the credit unions to your comparison set, click on the institution’s name and then use the arrow button to move them down into the selected comparison box, or you can double click and they’ll pop down automatically.

- After you have selected your institutions, click select and analyze and you are ready start using the tool.

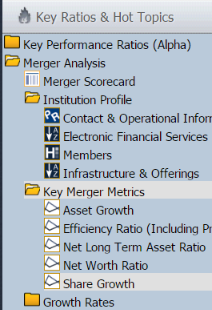

What Now? You’re set up to analyze your merger! You can build your own display or you can head to the left-hand navigation in Peer-to-Peer and select Key Ratios & Hot Topics, then Merger Analysis, to make use of the built-in tools prepared by the Callahan Industry Analytics Team.

Read on below to get a step-by-step overview of using the built-in Merger Analysis Packet.

You can find your merged institution under the ‘Primary’ selection screen. Select Merger for your primary point of analysis and select the saved merger on the right.

You can also select a Merger on the Comparison Set screen under ‘Institutions’. Select the type as ‘Merger’.

Video Tutorial: Merge Two Credit Unions

Hit play, then expand the video via the lower right-hand corner.

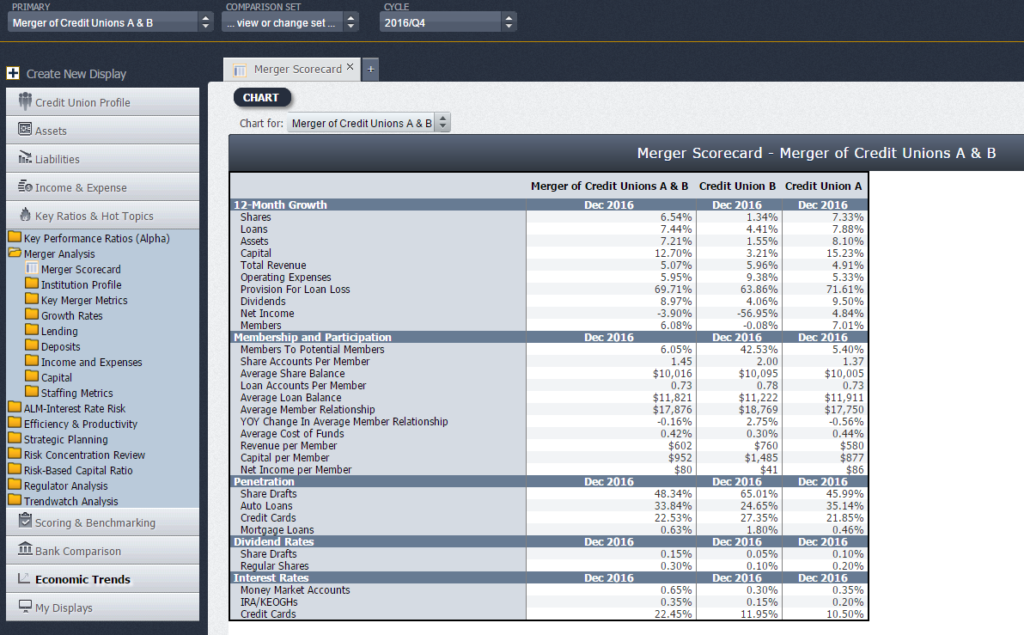

If you want to see what the combined financials of two merged institutions would look like, the merger scorecard display can be extremely informative.

This display offers a view of the combined entities of the merger. Here you will find key ratios which allow you to assess the financial position and performance both institutions on an individual basis, as well as for the merged institution.

One important thing to note: to project the merged institution, Peer-to-Peer simply combines the account codes for the various line items; in an actual merger, certain items will have different weightings and will be re-priced as determined by NCUA and financial accounting guidelines.

The merger scorecard offers a very high level analysis.  If you would like a more granular view of the data or a specific metric, there are eight additional sub-folders of displays ready for your analysis.

If you would like a more granular view of the data or a specific metric, there are eight additional sub-folders of displays ready for your analysis.

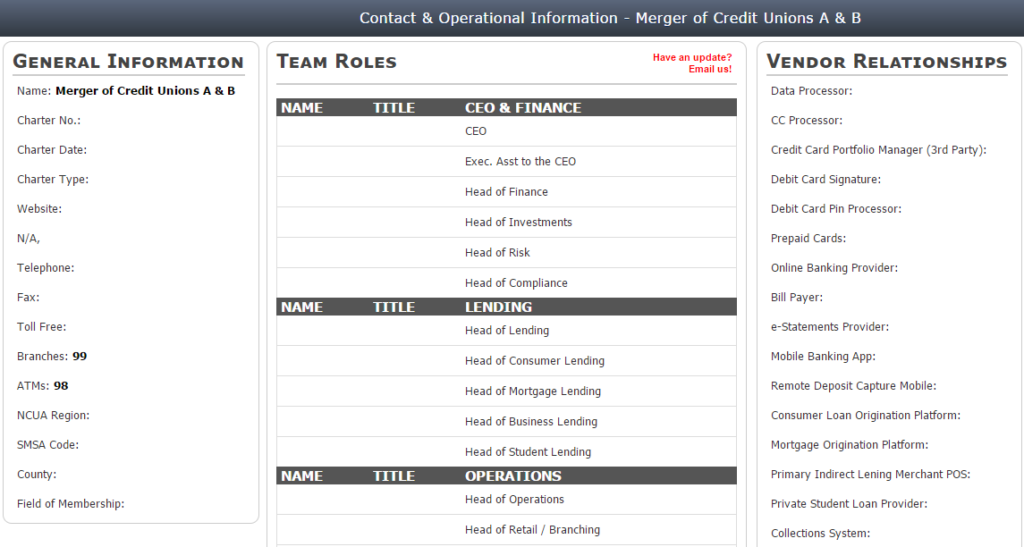

The Institution Profile section of the Merger Analysis Packet includes four different displays:

- Contact & Operational Information

- Electronic Financial Services & Delivery Channels

- Members

- Infrastructure & Offerings

Contact & Operational Information

This display includes a summary of qualitative information gathered by Callahan and can offer you important perspective into the types of alignment that exists or does not exist within a prospective merger.

General information about the institution, including:

- Charter Number/Date/Type/Field of Membership

- Website

- Address/Phone/Fax/NCUA Region/County

- Number of Branches

- Number of ATMs

Names, Titles, and Department-Level Contacts

- Breaks down contacts by department, such as CEO & Finance

- Specifies a contact’s name and title,

Vendor Relationships

- Data/CC/Debit Card Pin Processors

- 3rd Party CC Portfolio Manager

- Prepaid Cards

- Online Banking/Mobile Banking Providers

- Bill Payer

- Remote Deposit Capture Mobile

- e-Statements Provider

- Consumer Loan/Mortgage Origination Platforms

- Student Loan Provider

- Collections System

- Primary Indirect Lending Merchant POS

- Lending Call Center

- Auditor

- Apple Pay

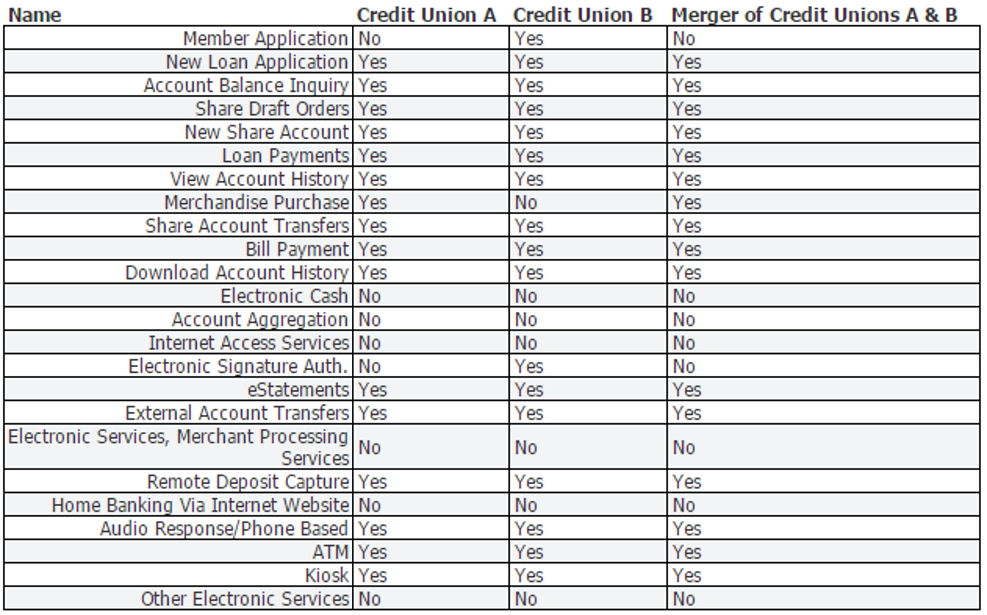

Electronic Financial Services & Delivery Channels

Often, mergers are more complex than what initially meets the eye, and while the ability to project what a combined entity would look like from a financial perspective is certainly important, there is also value to be gleaned from examining how the two institutions compare in other areas.

The electronic financial services and delivery channels display offers another view of how the two institutions compare, detailing their various member service offerings.

Members

This display offers a straightforward way of looking at how membership might change in a merger scenario.

Infrastructure & Offerings

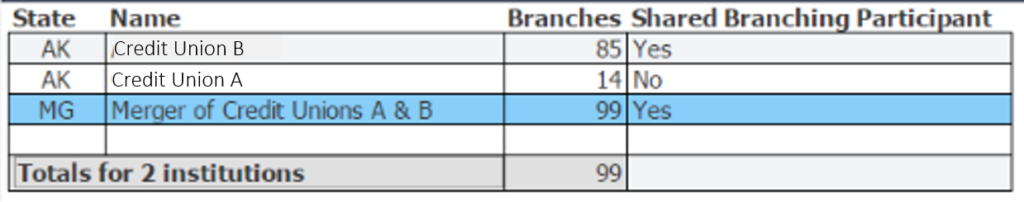

The infrastructure and offerings display offers you a quick snapshot of how merger participants’ branch count compare, as well as involvement in shared branching.

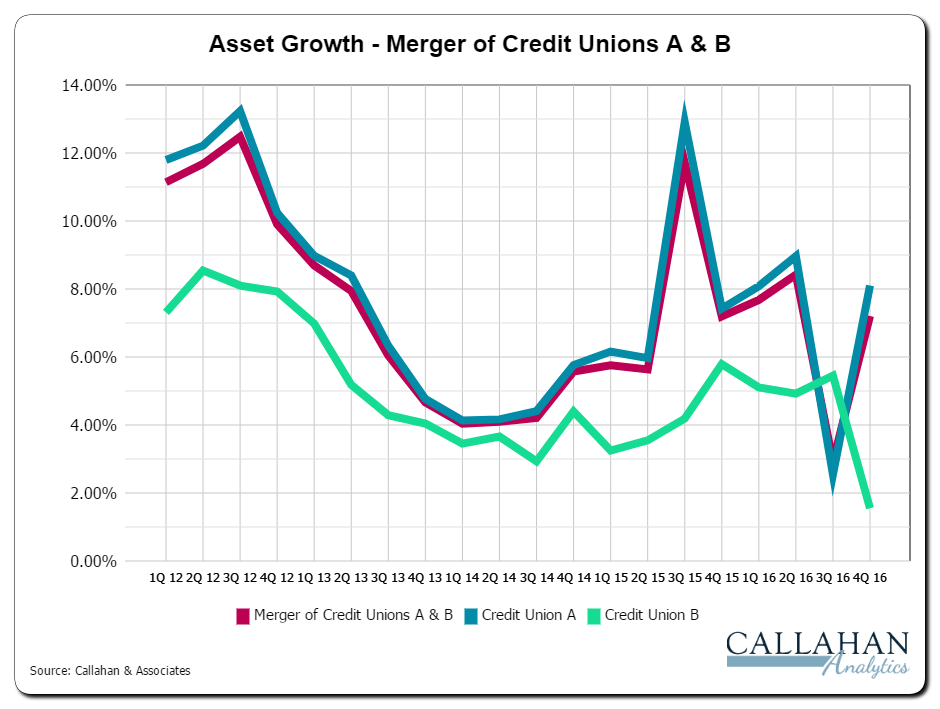

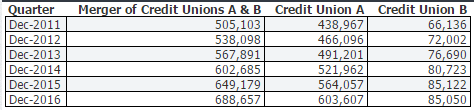

Key merger metrics provide you with pre-built displays for the following metrics:

- Asset Growth

- Efficiency Ratio (Including Provision for Loan Losses)

- Net Long Term Asset Ratio

- Net Worth Ratio

- Share Growth

To get the most out of this section, and indeed all of the Merger Analysis packet, we highly recommend that you set the institutions you’re merging as your comparison set. This ensures that your graphs show the merged credit union as well as each of the potential merger participants.

For Example: