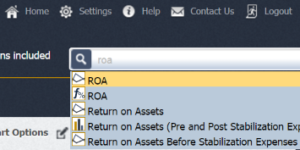

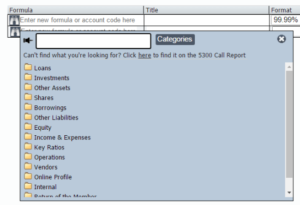

Did you search for a formula or ratio?

You’re ALMOST in the right place!

In Peer-to-Peer, there are two primary ways to use formula names, ratios, or account codes to power hundreds of built-in displays or custom analysis. You can also modify and customize these inputs.

Here’s how to use formulas and account codes in Peer-to-Peer:

For more on formulas, check out these guides:

All Common Formulas

In the below sections, we’ve included lists of the most common formulas used in Peer-to-Peer.

To find one of these in Peer-to-Peer, use Universal Search or Formula Wizard, as described on the right.

- # Delinquent Loans & Leases (2+ months)

- $ Delinquent Loans & Leases (2+ months)

- 1st Mortgage Delinquency

- Auto Loan Delinquency (total)

- Auto Loan Net Charge Offs (total)

- Credit Card Delinquency

- Credit Card Net Charge-Offs

- Delinquency (total)

- First Mortgage Net Charge-Offs

- Indirect Delinquency

- Indirect Loan Net Charge-Offs

- Leases Delinquency

- Leases Net Charge-Offs

- Member Business Loans Delinquency (total)

- Member Business Loans Non-Real Estate Secured Delinquency

- Member Business Loans Non-Real Estate Secured Net Charge-Offs

- Member Business Loans Real Estate Secured Delinquency

- Member Business Loans Real Estate Secured Net Charge-Offs

- Net Charge-Offs (total)

- New Auto Loan Delinquency

- New Auto Loan Net Charge-Offs

- Other Loans Delinquency

- Other Loans Net Charge-Offs

- Other Real Estate Delinquency

- Other Real Estate Net Charge-Offs

- Payday Alternative Loan Delinquency

- Payday Loans Net Charge-Offs

- Real Estate Delinquency (total)

- Real Estate Net Charge-Offs (total)

- Student Loan Delinquency

- Student Loan Net Charge-Offs

- Total Member Business Loans Net Charge-Offs

- Used Auto Loan Delinquency

- Used Auto Loan Net Charge-Offs

- # 1st Mortgage Adjustable Rate

- # 1st Mortgage Balloon/Hybrid

- # 1st Mortgage Fixed Rate

- # All Other Loans/LOC

- # All Other Unsecured Loans/LOC

- # Auto Loans (total outstanding)

- # First Mortgage Loans/LOC

- # Leases Receivable

- # Loans (total outstanding)

- # MBL, Real Estate Secured, Outstanding

- # Member Business Loans (MBL) Outstanding

- # New Auto Loans

- # Other Real Estate Loans/LOC

- # Private Student Loans

- # Real Estate Loans (total outstanding)

- # Short-Term, Small Amount Loans (FCU Only)

- # Unsecured Credit Card Loans

- # Used Auto Loans

- $ 1st Mortgage Adjustable Rate Outstanding

- $ 1st Mortgage Balloon/Hybrid Outstanding

- $ 1st Mortgage Fixed Rate Outstanding

- $ 1st Mortgage Loans/LOC

- $ All Other Unsecured Loans/LOC

- $ Allowance for Loan & Lease Losses

- $ Allowance for Losses on All Real Estate Loans

- $ Indirect Loans (total)

- $ Leases Receivable

- $ Loans (total outstanding)

- $ MBL, Real Estate Secured, Outstanding

- $ Member Business Loans (MBL)

- $ New Auto Loans

- $ Other Loans/LOC

- $ Other Real Estate Loans/LOC

- $ Private Student Loans

- $ Short-Term, Small Amount Loans (FCU Only)

- $ Total Auto Loans

- $ Total Auto Loans/Loans

- $ Unsecured Credit Card Loans

- $ Used Auto Loans

- 12-Month 1st Mortgage Growth

- 12-Month Auto Growth

- 12-Month Credit Card Growth

- 12-month Loan Growth

- 12-Month MBL Growth

- 12-Month New Auto Growth

- 12-Month Other Real Estate Growth

- 12-Month Real Estate Growth

- 12-Month Used Auto Growth

- 1st Mortgage Penetration

- Auto Loan Penetration

- Credit Card Penetration

- New Auto Loan Penetration

- Real Estate Loans Outstanding

- Real Estate Penetration

- Used Auto Loan Penetration

- $ Borrowing Repurchase Transactions, Total

- $ Borrowings (total)

- $ Draws against LOC

- $ Other Notes, Promissory Notes and Interest Payable

- $ Subordinated Debt (total)

- $ Subordinated Debt included in Net Worth

- $ Equity, Accumulated Unrealized Gains (Losses) on Available for Sale (AFS) Securities

- $ Equity, Accumulated Unrealized Net Gains (Losses) on Cash Flow Hedges

- $ Equity, Appropriation for Non-Conforming Investments (SCU ONLY)

- $ Equity, Other Comprehensive Income

- $ Equity, Other Reserves

- $ Equity, Regular Reserves

- $ Equity, Undivided Earnings

- $ Net Income (Equity, net of contribution to Undivided Earnings)

- $ Total Liabilities, Shares, and Equity

- Accumulated Unrealized Losses for OTTI (Due to Other Factors) on HTM Debt Securities

- Capital (total)

- Capital/Assets

- Equity Acquired in Merger

- Miscellaneous Equity

- Net Worth

- Net Worth Ratio

- RBC Ratio

- $ Dividends on Shares

- $ Educational and Promotional Expense (Marketing Expenses)

- $ Employee Compensation & Benefits

- $ Fee Income

- $ Gain from Bargain Purchase (Merger)

- $ Income from Investments

- $ Interest Expense

- $ Interest Income

- $ Interest on Borrowed Money

- $ Interest on Deposits (SCU Only)

- $ Interest on Loans (Gross-before interest refunds)

- $ Loan Interest Refunded

- $ Loan Servicing Expense

- $ Member Insurance

- $ Miscellaneous Operating Expenses

- $ Net Income (Loss)

- $ Net Interest Income After Provision

- $ Non-Interest Expense

- $ Non-Interest Income

- $ Office Occupancy Expense

- $ Office Operations Expense

- $ Operating Fees (Examination and/or supervision fees)

- $ OTTI Losses Recognized in Earnings

- $ Portion OTTI Losses in Other Comprehensive Income

- $ Professional & Outside Services

- $ Provision for Loan & Lease Losses

- $ Trading Profits and Losses

- $ Transfer to Regular Reserve

- $ Travel and Conference Expense

- $ Other-Than-Temporary Impairment (OTTI) Losses

- Gain (Loss) associated with the Hedged Item (Investments) in a Non-Trading, Fair Value Derivatives Hedge

- Gain (Loss) on Disposition of Fixed Assets

- Gain (Loss) on Investments

- Gain (Loss) on Non-Trading Derivatives

- NCUSIF Premium Expense

- NCUSIF Stabilization Expense

- Net Income/Loss Before Stabilization Expense

- Other Member Insurance Expense

- Other Non-Operating Income

- Account Aggregation

- Account Balance Inquiry

- Audio Response/Phone Based

- Automatic Teller Machine (ATM)

- Bill Payment

- Download Account History

- Electronic Cash

- Electronic Signature Authentication/Certification

- eStatements

- External Account Transfers

- Home Banking/PC Based

- Internet Access Services

- Kiosk

- Loan Payments

- Member Application

- Merchandise Purchase

- Merchant Processing Services

- Mobile Banking

- Mobile Payments

- New Loan

- New Share Account

- Other

- Remote Deposit Capture

- Share Account Transfers

- Share Draft Orders

- View Account History

- Available for Sale Securities (total)

- Cash at Corporate CU

- Cash at Other Financial Institutions

- Cash Equiv. (Invests w/ Original Maturities < 3 Mths)

- Cash on Deposit

- Cash on Hand

- Held-to-Maturity Securities (total)

- Investments (total)

- Total All other investments

- Total All other investments in corporate credit unions

- Total Deposits in commercial banks, S&Ls, savings banks

- Total Investments <= 1 Year

- Total Investments >10 Years

- Total Investments 1-3 Years

- Total Investments 3-5 Years

- Total Investments 5-10 Years

- Total Loans to and investments in natural person credit unions

- Total Membership capital at corp CUs/Nonperpetual Contributed Capital

- Total Paid-in capital at corp CUs/Perpetual Contributed Capital

- Trading Securities (total)

- $ Revenue per $ Salary & Benefits

- Accounts Per Member

- Assets per Employee (FTE)

- Average Cost of Funds

- Average Loan Balance

- Average Member Relationship

- Average Share Balance

- coverage_ratio

- Efficiency Ratio (excluding Provision for Loan Losses)

- Efficiency Ratio (including Provision for Loan Losses)

- Fixed Assets

- Income per Employee (FTE)

- Interest Income/Average Assets

- Interest Income/Total Income

- Loan Originations per Employee (FTE)

- Loan Originations per Member

- Loans to Shares

- Members per Employee (FTE)

- Net Interest Margin

- Net Operating Expense/Average Assets

- Non-Interest Income per Employee (FTE)

- Non-Interest Income per Member

- Non-Interest Income/Average Assets

- Non-Interest Income/Total Income

- Operating Expense Ratio

- Operating Expense Ratio before NCUSIF & TCCUSF Assessments

- Operating Expense/Gross Income

- Provision for Loan Losses/Avg. Assets

- Return on Assets

- Return on Equity

- Salary and Benefits per Employee (FTE)

- Yield on Earning Assets

- Yield on Investments

- Yield on Loans

- ATM/Debit Card Program

- Bilingual Services

- Business Loans

- Business Share Accounts

- Check Cashing

- Credit Builder

- Debt Cancellation/ Suspension

- Direct Financing Leases

- Financial Counseling

- Financial Education

- Financial Literacy Workshops

- First Time Homebuyer Program

- Health Savings Accounts (HSA)

- In-School Branches

- Indirect Business Loans

- Indirect Consumer Loans

- Indirect Mortgage Loans

- Individual Development Accounts (IDA)

- Interest Only or Pymnt Option 1st Mortgage Loans

- Micro Business Loans

- Micro Consumer Loans

- Money Orders

- No Cost Bill Payer

- No Cost Share Drafts

- No Cost Tax Preparation

- No Surcharge ATMs

- Overdraft Lines of Credit

- Overdraft Protection/ Courtesy Pay

- Participation Loans

- Pay Day Loans

- Prepaid Debit Cards

- Real Estate Loans

- Refund Anticipation Loans

- Risk-Based Loans

- Share Certificates, Low Minimum Balance

- Share Secured Credit Cards

- Student Scholarships

- # current members

- 12-Month Employee Growth

- 12-Month Member Growth

- Address

- ATMs

- Branches

- CEO

- CFO

- Charter Number

- CharterTypeCode

- Chief Executive Officer

- Chief Financial Officer

- City

- Employees

- Field of Membership

- State

- Telephone

- Zip code

- # 1st Mortgage Originations YTD

- # Adjustable Rate 1st Mortgage Loans Granted YTD

- # Balloon/Hybrid 1st Mortgage Loans Granted YTD

- # Consumer Loans YTD Originations

- # Fixed Rate 1st Mortgage Loans Granted YTD

- # Loans Granted YTD

- # Member Business Loans Granted or Purchased YTD

- # Other Real Estate YTD Originations

- $ 1st Mortgage YTD Originations

- $ 1st Mortgages Sold to Secondary Market YTD

- $ Adjustable Rate 1st Mortgage Loans Granted YTD

- $ Balloon/Hybrid 1st Mortgage Loans Granted YTD

- $ Consumer Loans YTD Originations

- $ Fixed Rate 1st Mortgage Loans Granted YTD

- $ Loans Granted YTD

- $ Member Business Loans (MBL) Granted or Purchased YTD

- $ Other Real Estate YTD Originations

- 12-Month 1st Mortgage YTD Origination Growth

- 12-Month Consumer Loans YTD Origination Growth

- 12-Month MBL Granted or Purchased YTD Growth

- 12-Month Other Real Estate YTD Origination Growth

- 12-Month YTD Loan Origination Growth

- 1st Mortgages Sold / YTD 1st Mortgage Originations

- $ Foreclosed & Repossessed Assets, Autos

- $ Foreclosed & Repossessed Assets, Other

- $ Foreclosed & Repossessed Assets, Real Estate

- $ Foreclosed & Repossessed Assets, Total

- $ Intangible Assets, Goodwill

- $ Intangible Assets, Identifiable Intangible Asset

- $ Intangible Assets, Total

- $ Land and Building Asset

- $ NCUA Share Insurance Capitalization Deposit

- $ Other Assets

- $ Other Fixed Assets

- Accrued Interest on Investments

- Accrued Interest on Loans

- All Other Assets

- Assets (total)

- Net Non-Trading Derivative Assets

- Recovery

- $ Business Share Accounts

- $ Employee Benefit Member Shares

- $ Employee Benefit Nonmember Shares

- $ Health Savings Accounts

- $ Held by Member Government Depositors

- $ Held by Nonmember Government Depositors

- $ IRA/Keogh Accounts = or > $100,000

- $ Share Certificates = or > $100,000

- $ Share Drafts Swept to Regular Shares or Money Market Accounts

- 529 Plan Member Deposits

- Non-dollar denominated deposits

- Interest Rate, 1st Mortgage Loans/LOC

- Interest Rate, All Other Loans/LOC

- Interest Rate, Credit Cards

- Interest Rate, Leases

- Interest Rate, New Auto

- Interest Rate, Other Real Estate Loans/LOC

- Interest Rate, Other Unsecured Loans/LOC

- Interest Rate, Private Student Loans

- Interest Rate, Short-Term, Small Amount Loans (FCU Only)

- Interest Rate, Used Auto

- # All other Share Accounts

- # IRA/KEOGH Accounts

- # Money Market Share Accounts

- # Non-Member Deposit Accounts

- # Regular Share Accounts

- # Share Certificates

- # Share Draft Accounts

- $ All Other Shares

- $ Core Deposits

- $ IRA/KEOGH Accounts

- $ Money Market Shares

- $ Non-Member Deposits

- $ Regular Shares

- $ Share Certificates

- $ Share Drafts

- $ Shares (total, excluding nonMember Deposits)

- Dividend Rate, Regular Shares

- Interest Rate, All Other Shares

- Interest Rate, IRA/KEOGHs

- Interest Rate, Money Market Accounts

- Interest Rate, Non-Member Deposits

- Interest Rate, Share Certificates (1+ year)

- Share Accounts (total, excluding nonMember Deposits)

- Share and NonMember Deposit Accounts (total)

- Share Draft Penetration

- Share Draft Rate

- Shares and NonMember Deposits (total)

- 3rd Party ALM Analysis Partner

- ALM Software

- Apple Pay

- Auditor

- Bill Payer

- Check 21 – Teller Solution

- Check Printer

- Consumer Loan Origination Platform

- Credit Card Portfolio Manager

- Data Processor

- Debit Card PIN Processor

- Debit Card Signature Processor

- e-Statements Provider

- EFT Processor (ACH)

- Lending Call Center

- MCIF Analysis Solution

- Mobile Banking App

- Mobile Banking Browser

- Mortgage Origination Platform

- Mutual Funds

- Online Banking Provider

- Outsourced Call Center – member services

- Personal Financial Management

- Prepaid Cards

- Primary First Mortgage Servicer

- Primary Indirect Lending Platform–Auto

- Primary Indirect Lending Platform–Merchant POS

- Private Student Loan Provider

or displays (or CU names, peer groups, and more) if you:

or displays (or CU names, peer groups, and more) if you: rs icon) found in our peer group and custom display builders that can be used to help find:

rs icon) found in our peer group and custom display builders that can be used to help find: