Scoring: Your Credit Union Performance Profile

The Credit Union Performance Profile was developed by Callahan & Associates to quantify key areas of asset quality, capital adequacy, earnings and operating efficiency, and liquidity. This scorecard was designed to mirror CAMEL, the NCUA’s rating system, and serves as a great alternative when determining whether you are prepared for your annual NCUA examination.

- Make sure your analysis is properly set up with an individual institution as your primary point and your NCUA asset-based peer group as your comparison set.

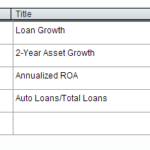

- There are four sections that make up the Credit Union Performance Profile scoring system within the “Summary for Credit Union” display. Under each of the four sections, there are five ratios that are used to calculate the corresponding section. Begin your analysis by opening up your Credit Union Performance Scorecard here.

You can also find this display in the left navigation bar under “Scoring & Benchmarking” > “CUPP Scoring System”.