In today’s changing financial landscape, credit unions face a host of challenges when it comes to maintaining stability and ensuring member protection.

Recently, the National Credit Union Administration (NCUA) outlined its supervisory priorities for 2024, highlighting several key areas of focus.

Below we’ll breakdown what’s top of mind for credit union leaders navigating risk.

Credit Risk and Economic Environment:

Credit risk management is essential for credit unions to safeguard their financial health. Inflation and high interest rates have made credit risk assessments even more important this year. Metrics such as delinquency ratios and loan loss forecasting methods play a crucial role in identifying potential risks and implementing appropriate risk-mitigation strategies.

U.S. Credit Unions | Data as of 12.31.2023

-

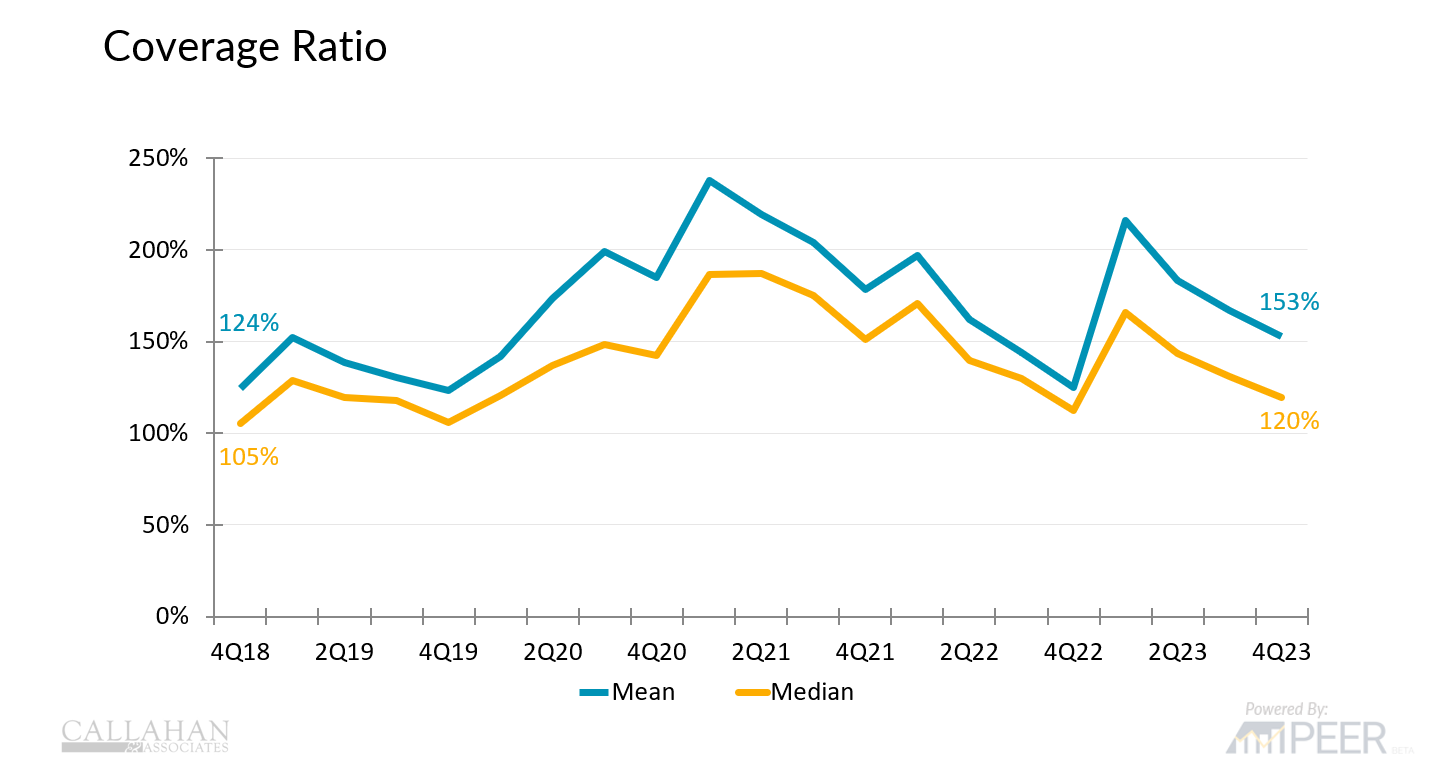

The coverage ratio measures the amount credit unions have set aside in their allowance account relative to delinquent loans outstanding, making it an important measure of protection against credit risk.

-

As of year-end, U.S. credit unions had an average of $1.53 set aside for every dollar of delinquent loans on their books. This is still at a healthy level, but coverage declined throughout 2023 despite credit unions increasing their provision expenses.

Pro Tip For Peer Suite Users

As you prepare for upcoming regulatory conversations, we recommend leveraging the brand new 2024 NCUA Supervisory Priorities dashboard in Peer Suite.

Not yet a Callahan client? If you’re interested in viewing your credit union’s performance dashboard, complete this form and our team will be with you shortly.

Liquidity Challenges and Opportunities:

Liquidity management is paramount for credit unions to ensure their ability to meet member needs and obligations. Amid declining share growth, credit unions face liquidity challenges that require careful navigation.

Strategies for attracting deposits and leveraging liquidity to support members not only safegaurd financial stability but also enhance member satisfaction and trust.

U.S. Credit Unions | Data as of 12.31.2023

-

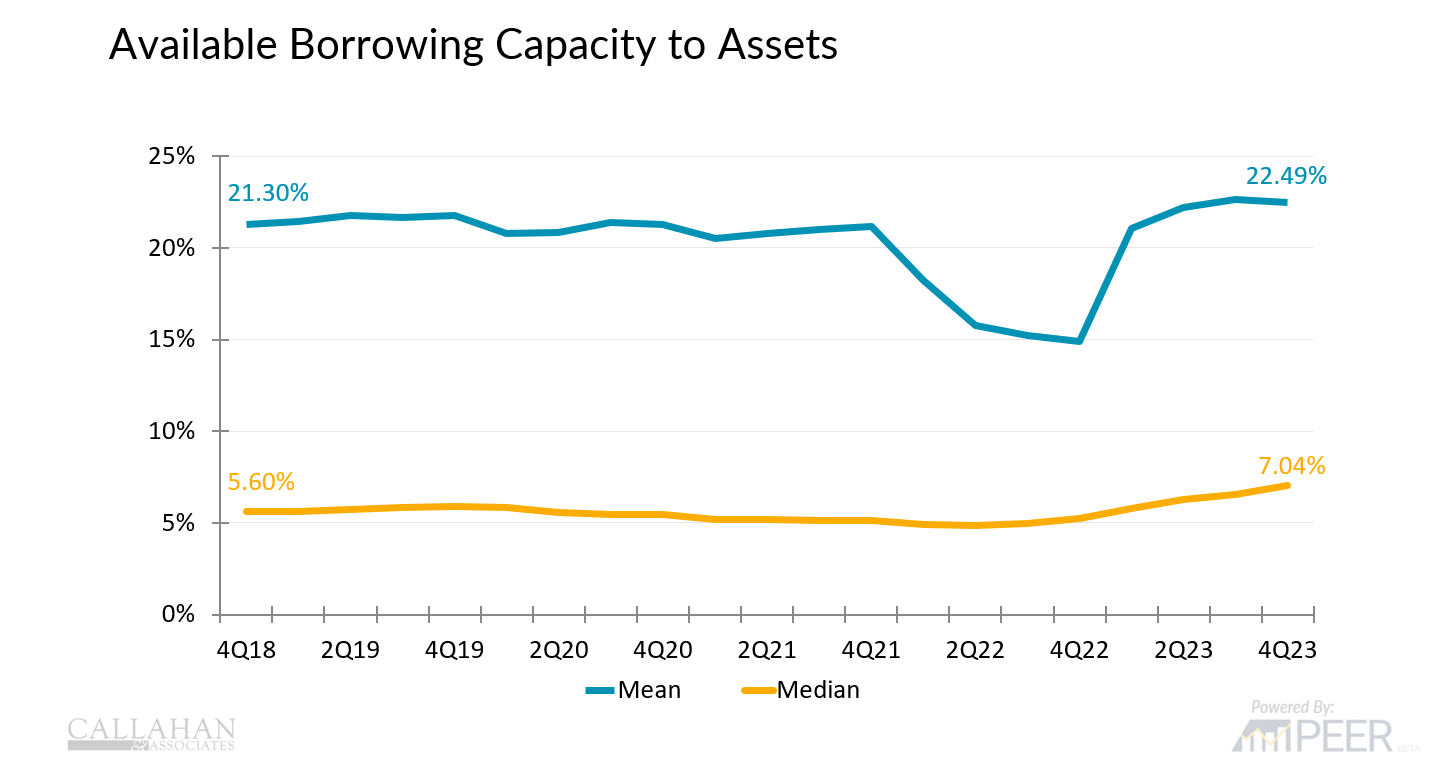

Available borrowing capacity relative to assets measures the strength of credit unions’ liquidity safety net. This is important if the credit union needs to quickly source funds to maintain liquidity and institutional stability should economic conditions worsen.

-

The credit union industry had an available borrowing capacity of 22.49% of assets as of December 2023. This signals that the industry as a whole is prepared for potential liquidity emergencies.

Interest Rate Risk Management:

Effective management of interest rate risk is crucial for credit unions to protect their balance sheets and maintain profitability. In a volatile interest rate environment, credit unions must carefully monitor investment portfolio strategies and asset repricing practices.

Understanding the implications of interest rate fluctuations on loan paydown rates and asset valuations allows credit unions to make informed decisions and mitigate potential risks.

U.S. Credit Unions | Data as of 12.31.2023

-

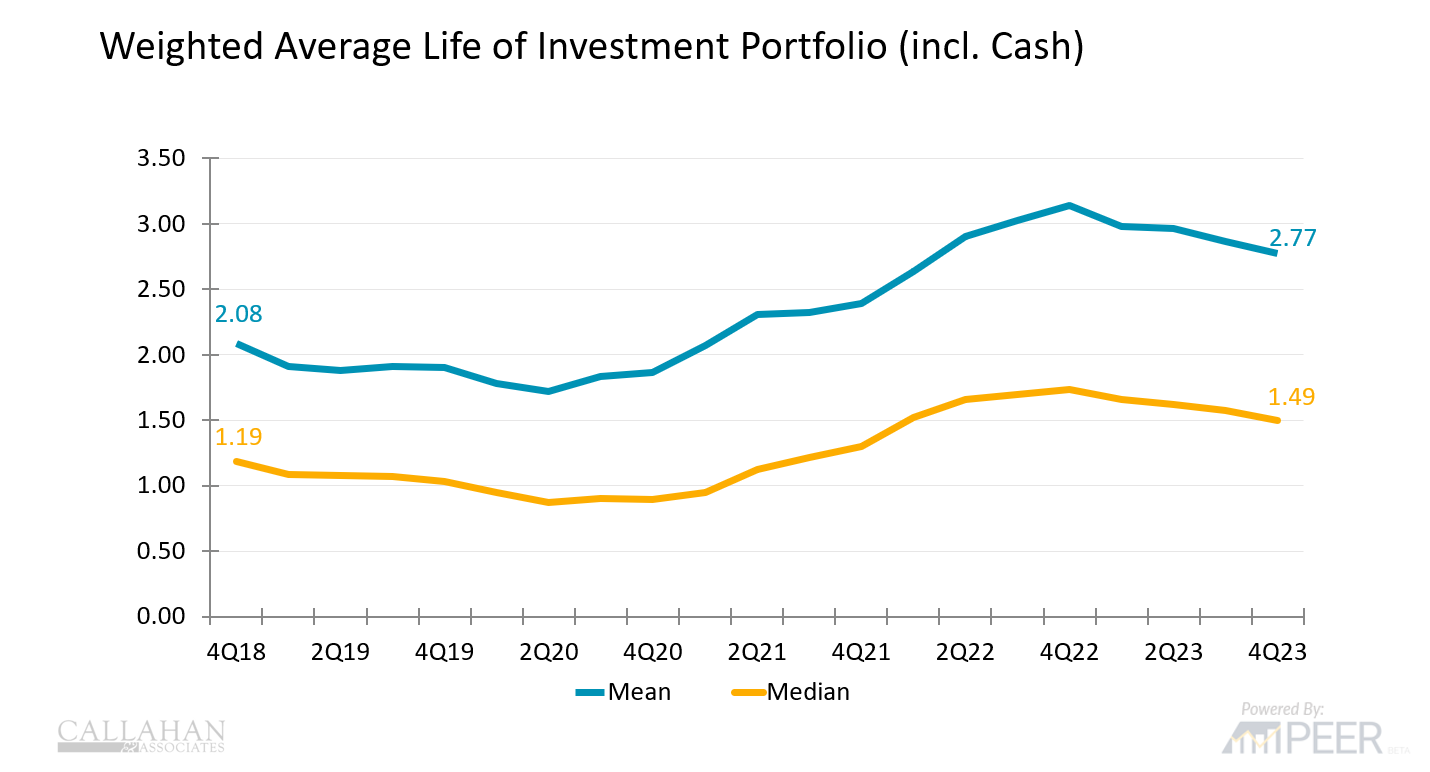

Credit unions’ investment portfolios that hold long-term securities will generally experience more volatility when interest rates change. Credit union examiners will be watching for this.

-

The weighted average life of the industry’s investment portfolio was 2.77 years as of year-end. This is an improvement from December 2022 because credit unions slowed purchases of longer-term securities. As securities matured, credit unions kept the proceeds in cash or short-term investments to improve liquidity.

The NCUA’s 2024 supervisory priorities offer valuable guidance for credit unions. By prioritizing credit risk, liquidity, consumer financial protection, and interest rate risk management, credit unions can enhance their resilience and ensure their long-term success.

Evaluate Your Risk | Free Performance Dashboard

With a focus on liquidity, credit, and interest rate risk focus areas, we’ll help you uncover your institution’s performance against local and industry-wide peers.

We request 30 minutes of your time to create a peer group that’s most relevant to your institution, and you’ll get to keep the results for free.

More Blogs

Expertise Matters. Be The Partner Clients Trust.

For credit union suppliers to be considered indispensable, it’s more important than ever to know their clients' and prospects' businesses inside and out. Credit unions are looking for more than just basic products and services from their suppliers – they need partners...

Understanding Credit Union Financial Reports

The ability to understand a credit union’s financial performance is one of the most vital skills for industry suppliers and service organizations. Armed with this knowledge and having a basic understanding of a credit union’s financial reports can help sales and...

Callahan & Associates and CU Strategic Planning Combine To Increase Credit Union Impact

Callahan & Associates and CU Strategic Planning proudly announce their strategic alliance, driven by a shared vision to empower credit unions to make a meaningful impact on their members and communities.

Insights And Advice For Credit Union Leaders

Are you new to a leadership role or preparing for one? Are you focused on empowering future leaders? Are you a veteran leader looking to be inspired? We recently asked new and established leaders what it means to embrace different leadership styles, encourage culture changes, and what advice they have for the next generation of leaders.

5 Governance Tips for Credit Union Boards

Insights From Callahan Consultant, Chris Howard There’s a growing — albeit misguided — distrust of credit unions today, making effective governance more important than ever … and harder than ever. At its core, good governance is fairly simple, although never...

15 Key Ratios Every Credit Union Board Should Know

There are thousands of data points you can share with your board about your credit union’s performance, the industry, and the economy. The challenge is identifying which key ratios are most important to your credit union. If you’re looking for a list of key ratios and...

Why Great Lakes CU Is Betting Big On Partnerships

Last week, Callahan & Associates hosted the inaugural installment in its "A Conversation With..." webinar series, featuring Great Lakes Credit Union CEO Steve Bugg. In the exclusive conversation, Bugg emphasized the value partnerships can bring to the industry and...

Browse 5300 Call Reports With Ease.

Every CU 5300 Call Report – Instantly And Seamlessly. If your goal is to reach more credit unions with your products and services, you likely know all too well how long it takes to pull 5300 Call Reports for dozens of prospects to fuel your sales pipeline and...

How Sales Teams Work More Efficiently In Peer Suite

Is your team spending countless hours manually pulling reports and compiling data for your credit union prospects? Are you looking for a more efficient way to collaborate with your team and onboard new members? Callahan’s Peer Suite helps credit union suppliers...

Ultimate Benchmarking Guide For Credit Unions

What Is Benchmarking? Benchmarking is the interpretation and analysis of financial information in order to make direct performance comparisons to other credit unions, banks, and customized peer groups. It enables a credit union to track internal goals, identify...