Navigating Tough Questions:

How to Address Board Members’ Concerns about Financial Performance

As a credit union leader, you understand that one of your most important responsibilities is to articulate your credit union’s financial performance to the board of directors.

While this can be a relatively straightforward task when your credit union is performing well, it can be challenging to navigate tough questions when your financial performance is not meeting expectations.

Fortunately, with the right tools and strategies in place, you can effectively address questions and concerns from your board members.

Streamline Reporting With The Built-in Board/Governance Dashboard

Peer Suite’s performance-benchmarking features provide built-in dashboards that contain key performance indicators tailored for individual departments and board leaders at your organization.

These built-in dashboards are designed to give you a quick snapshot of your institution’s financial performance and identify areas where you may need to improve – all without lifting a finger.

Tell A Compelling Story With Comparison Sets That Go Beyond Asset Size

While comparative performance benchmarking against peers of similar asset sizes can provide valuable insights, it may not tell the complete story.

Credit unions face unique challenges and opportunities based on factors such as geographic location, field of membership, and business model. By creating custom peer groups based on criteria such as loan portfolio breakdowns or reliance on non-interest income, you can gain a more accurate understanding of your shop’s performance compared to other credit unions facing similar challenges and opportunities.

Peer Suite helps you quickly build a variety of peer groups to help you tell your performance story more easily . This approach can lead to more meaningful benchmarking, strategic conversations, and a clearer path to improving overall performance.

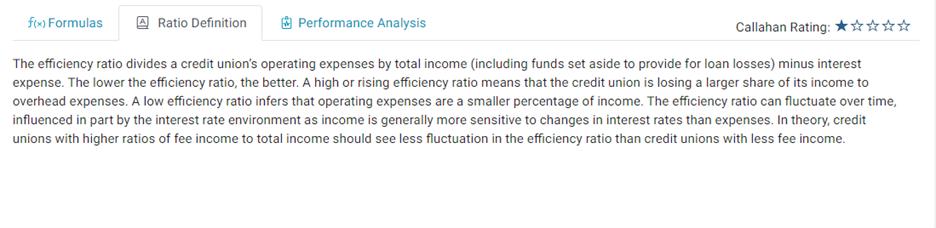

Interpret Display Metrics With Help From Ratio Definitions

It’s one thing to have all the metrics and performance indicators you need all in one place. It’s another thing entirely when you can understand how formula and account codes are used, and to see the benefits your can gain by tracking performance in order to answer difficult questions.

That’s why credit union leaders rely on Peer Suite’s built-in dashboards and ratio definitions.

This is particularly useful when you’re presenting financial performance data to board members who may not be familiar with financial jargon. By including definitions alongside the data, you can ensure everyone is on the same page when it comes to measuring the success of your institution.

Example Ratio Definition For Peer’s Efficiency Ratio Display

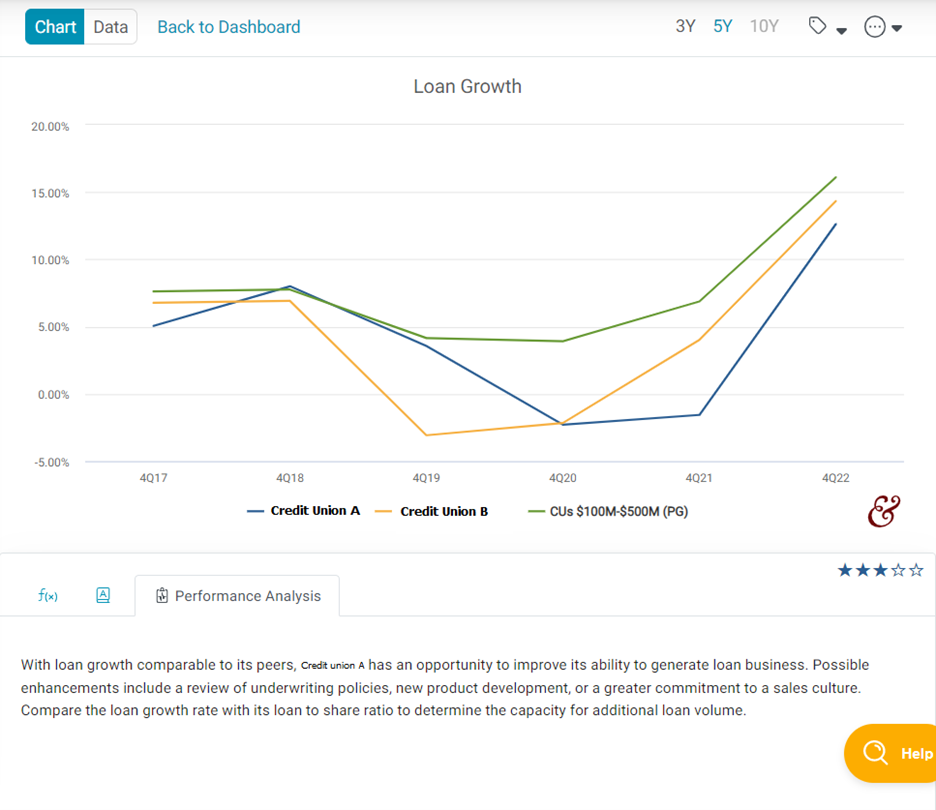

Performance Analysis From Our Data Experts

Finally, Peer Suite’s performance-benchmarking tool provides performance analysis from our data experts. Our team can help you identify areas where your credit union is under performing and provide recommendations for improvement.

This can be incredibly helpful when answering tough questions from board members who may be concerned about your credit union’s financial performance.

Navigating tough questions about financial performance can be challenging, but with the right tools and strategies in place, it can be done effectively.

Peer Suite‘s performance-benchmarking tool provides built-in dashboards, star rankings against comparison groups, definitions to better understand what a display measures, and performance analysis from our data experts, making it an invaluable tool for credit union executives. By leveraging these features, you can effectively articulate your credit union’s financial performance to the board of directors and address any concerns they may have.

Want to learn more about how your credit union could leverage Peer?

More Blogs

How Interra Is Advancing Its Purpose Journey

Several years ago, the five-member executive team of Interra Credit Union ($1.7B, Goshen, IN) participated in a virtual learning experience from Callahan & Associates offered in collaboration with Harvard Business School Online.

3 Peer Group Types That Go Beyond Asset Size

While benchmarking your performance against asset-based peer groups has value, relying strictly on asset size for peer group analysis can skew your benchmarks by including credit unions that don’t share much in common with your institution. Just take a look at this...

CECL: Everything You Need To Know

CECL: Everything You Need To Know In 2016, the Financial Accounting Standards Board announced that they would change the methods financial institutions used to calculate and report charge-offs. This new regulation changed the method from an Allowance for Loan and...

4 Most Commonly Confused Call Report Codes

Callahan's Tips For Correctly Reporting To The NCUA The NCUA’s 1Q22 5300 Call Report contained over 1,000 new, erased, and changed codes, leaving many credit unions in the dark on how to correctly report quarterly. As credit unions familiarize themselves with the...

Peer Suite Access Levels For Suppliers

Callahan & Associates is getting ready to launch four access levels within the Peer Suite for suppliers. Find out which access level is right for you.

Peer Suite Access Levels For Credit Unions

Callahan & Associates is getting ready to launch three access levels within the Peer Suite for credit unions. Find out which access level is right for you.

How BCU’s Purpose-Driven Mindset Drives Growth

Key Results from Sustainable Business Strategy In the first quarter of 2022, a dozen BCU ($5.4B, Vernon Hills, IL) team members participated in Sustainable Business Strategy, a virtual-learning experience offered by Callahan & Associates in collaboration...

Leverage Your Peers For Vendor Due Diligence

When it comes to picking the right digital banking vendors for your institution Callahan & Associates knows how important it is to conduct a robust analysis before signing on the dotted line. Often, vendors will offer a curated list of client referrals you can...

Let The Policy Exchange Expedite Your Hiring Process

There have been few moments in American history in which the economy has experienced as much whiplash as the COVID-19 pandemic. After an economic shutdown brought an extended period of turmoil and job loss, we experienced a rapid V-shaped recovery which has brought...

4 Easy Ways to Analyze 4Q Data on Peer+

With fourth-quarter data released by the NCUA, it’s the perfect opportunity to reflect and compare your institution to your peers using Peer+. With an intuitive and reimagined interface, strategic year-end reporting for your credit union has never been easier. Give...