More than 1,200 industry peers joined us on Aug. 11 for 2Q 2021 Trendwatch. Callahan highlighted trends in lending, membership, and more as behavior amongst credit union members changed in accordance with the steady economic reopening. Most notably, credit union assets topped $2 trillion for the first time as industry assets grew 13.2% year over year.

Lending saw some of the more dramatic changes. During the second quarter of 2021, the following trends emerged:

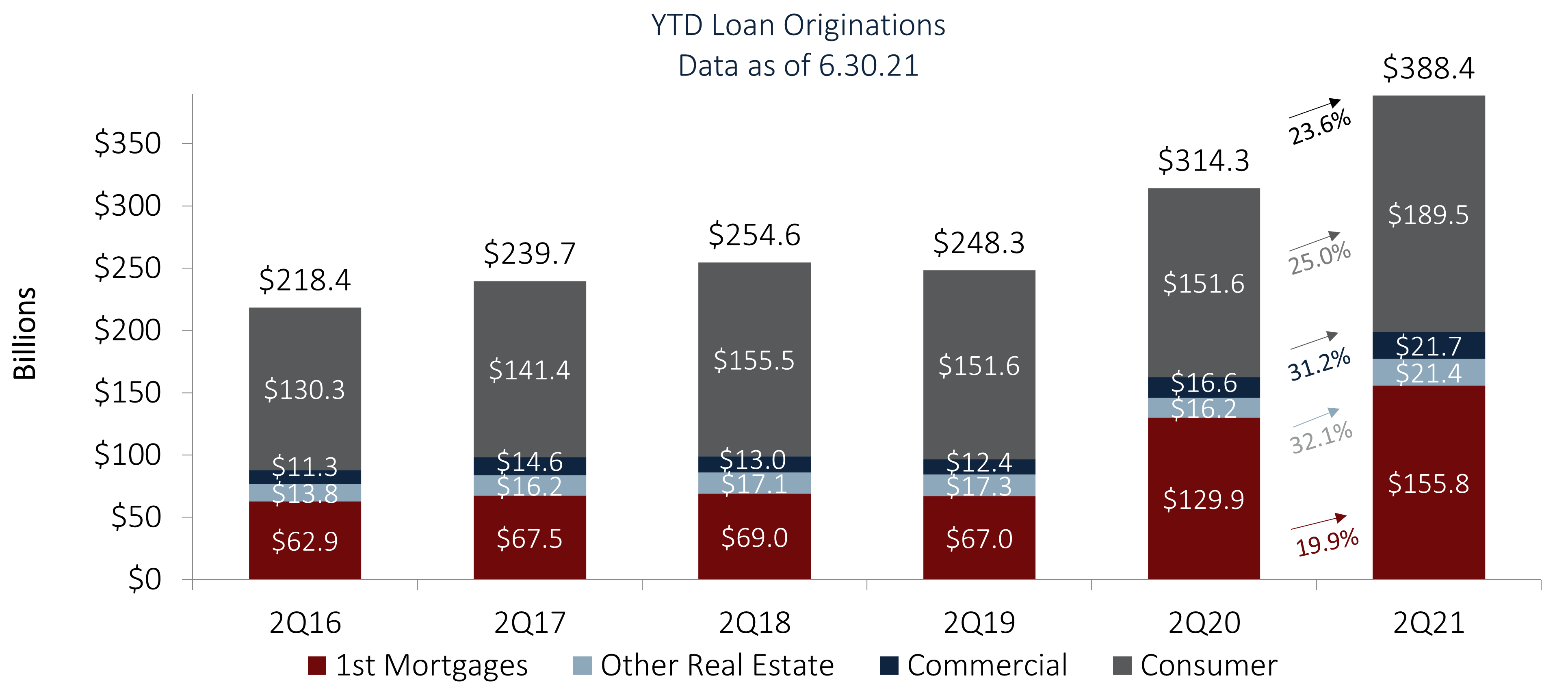

- Credit unions are supporting economic recovery by lending to members at an unmatched pace. Total year-to-date loan originations increased by more than 20% in dollar terms over each of the past two years.

- Credit unions originated 22.5 million loans for $388.4 billion in the first half of 2021, including a record $206.7 billion in the second quarter. As recently as 2014, the credit union industry had never collectively generated $388.4 billion in loan volume throughout a full calendar year, let alone over six months.

- While 1st mortgages drove loan originations over the first six months of last year, consumer lending – consisting predominantly of auto loans and revolving credit – is surging in the first half of 2021, outpacing 1st mortgage origination growth over the same period. Although the mortgage market remains hot in our low-interest-rate environment, the rebound of consumer lending is a hopeful sign for a recovering economy.

- Strong origination performance is starting to convert to balance sheet growth, as outstanding loan balances expanded over the second quarter across all major loan products.

- The industry’s loan-to-share ratio increased between March and June for the first time since the third quarter of 2019, as credit unions utilized some of their liquidity to meet member loan demand.

Year-to-date loan origination totals ($) increased by double digits annually in every major reported loan category between the first half of 2020 and the same period in 2021.

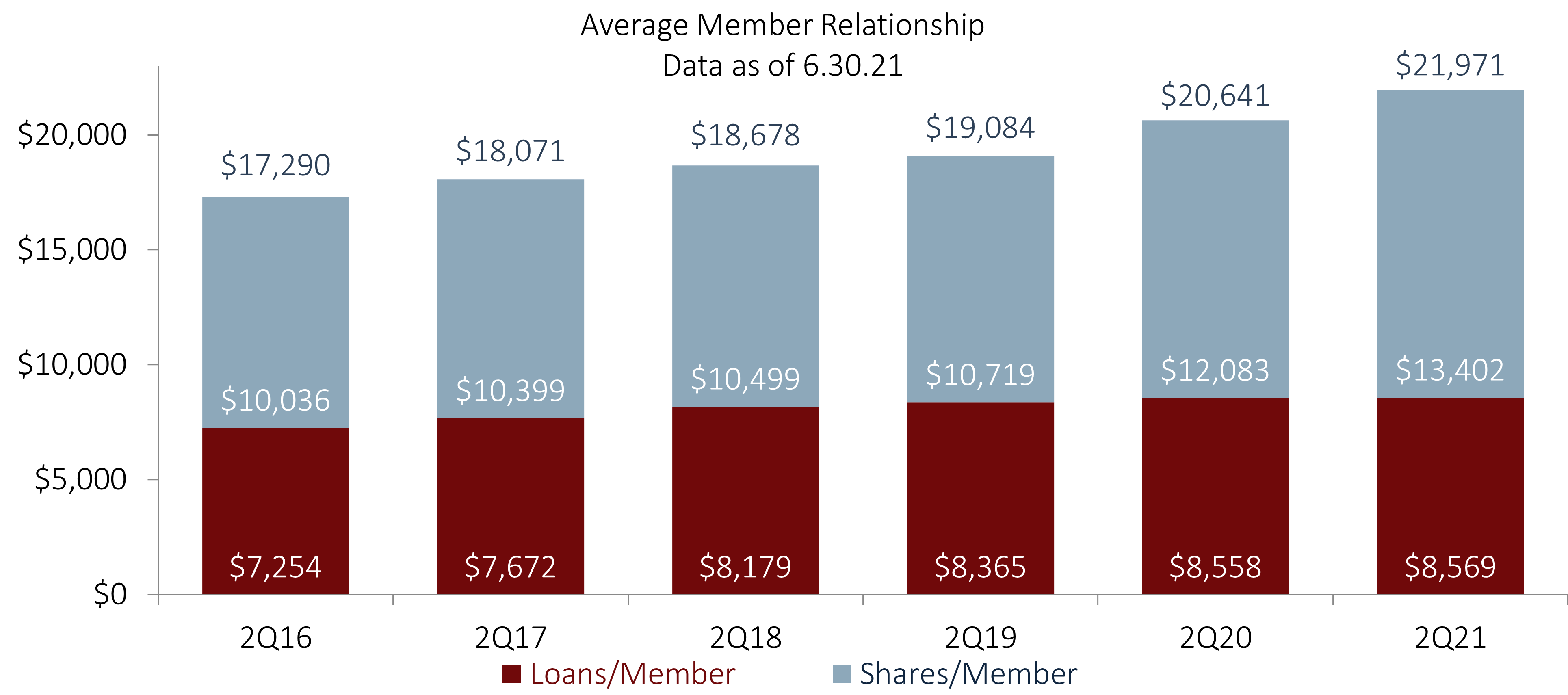

Membership and saving trends were also Trendwatch highlights. A total of 5.1 million Americans joined a credit union in the past 12 months, as membership expanded 4.1% year over year to reach a total of 128.8 million.

Meanwhile, total share balances increased $228.6 billion (15.2%) over the past year. Notably, member checking account balances have jumped 32% since last June as more than six in 10 members have checking accounts at their credit union today.

Credit unions have both increased total membership and deepened existing relationships over the past year. The average member relationship grew $1,130 over the past twelve months.

“Credit unions continue to provide a growing proportion of the American public with responsible and timely financial products and services. The challenges of the resurging pandemic lay before all of us, but the experience gained so far since COVID-19 began and the century-long foundation on which the member-owned financial cooperative rests give me confidence that together, the movement can again help millions of members weather the storm,” said Jon Jeffreys, president and CEO of Callahan & Associates.

A recording of the Aug. 11 Trendwatch can be viewed here. Click here for more takeaways from a Callahan analyst.

See Credit Union Data In Action With Peer-to-Peer

Every quarter, Callahan relies on our data and analytics tool, Peer-to-Peer, to analyze credit union performance data weeks before the official release from the NCUA.

Callahan clients can access Peer-to-Peer themselves via their client portal.

Not a client? Click here to request a custom data scorecard, unique to your credit union, and see what Peer can do for you.

More Blogs

4 Ways To Build A Meaningful Employee Recognition Program

In a Callahan client webinar, Rob Hoyle explains how Vantage West keeps credit union employee recognition meaningful, merit-based, and materially rewarding.

The Risk Of FOMO In Credit Union Leadership

Fear of missing out can drive credit union leaders to make big decisions for the wrong reasons. Recognize it, and learn to lead with clarity, purpose, and intentionality instead.

Callahan & Associates And Quantum Governance, L3C™ Unite to Advance Credit Union Governance

Callahan & Associates, a leading provider in performance measurement, leadership development, strategic advisory, and community development for credit unions, is excited to announce the acquisition of Quantum Governance, a nationally recognized consulting firm specializing in governance and strategy.

Tips To Make A Core Conversion Easier

Best practices for credit union core conversions.

Accessible Financial Services Matter More Than Ever

For millions of Americans, accessible financial services remain out of reach. In St. Louis, MO, Alltru FCU is changing that.

How To Use Credit Union Marketing Personas To Deepen Relationships

Rich knowledge of member behavior helps Solarity Credit Union segment its membership, create useful credit union marketing personas, and focus on deepening engagement.

How To Benchmark Credit Union Performance Against The Economy

Credit union executives and finance leaders face an increasingly complex task: explaining financial performance in a way that is both accurate and actionable. Traditional benchmarking approaches focus on two perspectives: Internal Trends – How your own institution’s...

Why Who You Benchmark Performance Against Matters More Than You Think

Too often, benchmarking is treated as a scorecard — a way to check performance against peers for board prep, audits, or strategic planning discussions. But the choice of peer group matters, it can help you tell a more complete story about your credit union’s performance and validate strategic decisions.

Why “Jobs To Be Done” Should Be At The Core Of Every Credit Union’s Strategy

Over the past decade, Callahan & Associates has worked closely with credit union leadership teams across the country to help them approach innovation and think more strategically about how they serve their members. A key part of this work has been rooted in...

Great Lakes Credit Union Featured In Callahan & Associates’ “Anatomy Of A Credit Union”

Washington, DC – Great Lakes Credit Union (GLCU) has been featured in the Spring 2025 edition of Callahan & Associates’ “Anatomy Of A Credit Union” series, which highlights exemplary credit unions demonstrating strategic innovation and community impact. The...