While benchmarking your performance against asset-based peer groups has value, relying strictly on asset size for peer group analysis can skew your benchmarks by including credit unions that don’t share much in common with your institution.

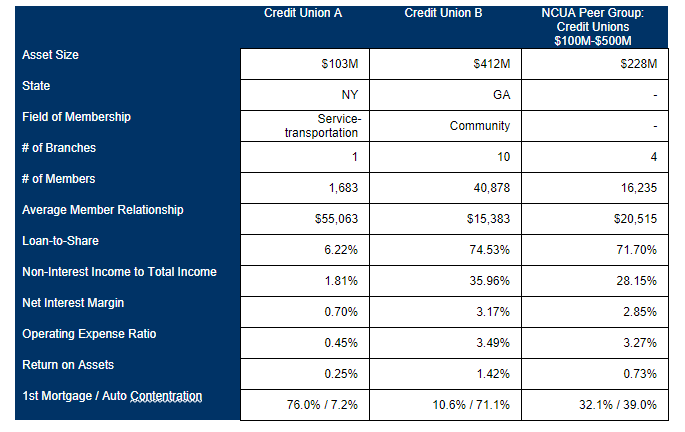

Just take a look at this actual example of two credit unions within the same NCUA-designated peer group:

*Data as of December 31st, 2022

As the table shows, these credit unions are not an ideal comparison for each other, despite their similarities. For more accurate benchmarks against which to measure your credit union’s performance, try using the criteria below in addition to asset size.

Three Peer Group Ideas That Go Beyond Asset Size

Local:

This peer group is comprised of credit unions around your asset size and located within your local market. These are your closest real competitors for the same membership. While differences in chartered fields of membership must always be considered, there are certainly unique economic and cultural characteristics that affect various regions of the country in different ways. A local peer group helps control your comparison based on these factors.

Request A Free Local Scorecard

Business Model:

This peer group is comprised of credit unions that are similar to you in a key aspect(s) of your current business model.

These are the credit unions most like you today, based on the way you operate. For this peer group, we generally recommend expanding the geographic range to broaden the net of available peers.

Sample Metrics For Your Business-Model Peer Group:

- Loan portfolio breakdowns.

- Reliance on non-interest income.

- Branch footprint.

- Single-SEG fields of membership.

Although these peer groups are similar, the insights really come from how you differ from the group. You may have a similar loan portfolio, but your earnings are dramatically less. What insights come out of that? What are your peers doing differently to spur earnings? Because no two credit unions have exactly the same business model, no peer group will ever be exactly the same as you.

Pro Tip: Pick just a few key filters first and isolate the differences.

Request A Free Business Model Scorecard

Aspirational:

These credit unions are doing something you know you want your credit union to do, but you’re not quite there yet.

An example of this might be a credit union that wants to launch its first credit card product. An aspirational peer group would include a few credit unions that have recently launched a credit card program, allowing you to see how the larger business was impacted by this change.

Other examples of aspirational peer groups include credit unions with above-average loan growth or ROA, or those that have recently completed a merger.

These peer groups can help you learn lessons from your peers, allowing you to set appropriate goals and expectations for the coming years.

Request A Free Aspirational Scorecard

Benchmark Your Credit Union’s Performance

Callahan’s data and the analytics tools within the Peer Suite make it easy to build custom peer groups using the data and strategies listed above and more. With hundreds of built-in formulas, graphs, and tables it’s easy to compare your credit union directly to relevant credit unions and banks.

Callahan clients can log in to the Callahan Portal to access these tools.

Don’t have access? Click here to request a custom scorecard and we’ll show you how easy it is to build comparisons in Peer.

More Blogs

How Interra Is Advancing Its Purpose Journey

Several years ago, the five-member executive team of Interra Credit Union ($1.7B, Goshen, IN) participated in a virtual learning experience from Callahan & Associates offered in collaboration with Harvard Business School Online.

How To Address Board Concerns On Performance

Navigating Tough Questions: How to Address Board Members' Concerns about Financial Performance As a credit union leader, you understand that one of your most important responsibilities is to articulate your credit union's financial performance to the board of...

CECL: Everything You Need To Know

CECL: Everything You Need To Know In 2016, the Financial Accounting Standards Board announced that they would change the methods financial institutions used to calculate and report charge-offs. This new regulation changed the method from an Allowance for Loan and...

4 Most Commonly Confused Call Report Codes

Callahan's Tips For Correctly Reporting To The NCUA The NCUA’s 1Q22 5300 Call Report contained over 1,000 new, erased, and changed codes, leaving many credit unions in the dark on how to correctly report quarterly. As credit unions familiarize themselves with the...

Peer Suite Access Levels For Suppliers

Callahan & Associates is getting ready to launch four access levels within the Peer Suite for suppliers. Find out which access level is right for you.

How BCU’s Purpose-Driven Mindset Drives Growth

Key Results from Sustainable Business Strategy In the first quarter of 2022, a dozen BCU ($5.4B, Vernon Hills, IL) team members participated in Sustainable Business Strategy, a virtual-learning experience offered by Callahan & Associates in collaboration...

Leverage Your Peers For Vendor Due Diligence

When it comes to picking the right digital banking vendors for your institution Callahan & Associates knows how important it is to conduct a robust analysis before signing on the dotted line. Often, vendors will offer a curated list of client referrals you can...

Let The Policy Exchange Expedite Your Hiring Process

There have been few moments in American history in which the economy has experienced as much whiplash as the COVID-19 pandemic. After an economic shutdown brought an extended period of turmoil and job loss, we experienced a rapid V-shaped recovery which has brought...

4 Easy Ways to Analyze 4Q Data on Peer+

With fourth-quarter data released by the NCUA, it’s the perfect opportunity to reflect and compare your institution to your peers using Peer+. With an intuitive and reimagined interface, strategic year-end reporting for your credit union has never been easier. Give...

Credit Unions See Record High Member Engagement and Relationships In 4Q21

More consumers than ever turned to credit unions in 2021. Total industry assets surpassed $2 trillion last year, as over 5.4 million Americans became new credit union members bringing total membership to 131.1 million. Additionally, the industry is seeing accelerated...