For credit union suppliers to be considered indispensable, it’s more important than ever to know their clients’ and prospects’ businesses inside and out.

Credit unions are looking for more than just basic products and services from their suppliers – they need partners who truly understand their unique challenges, opportunities, and goals.

For suppliers, this means going beyond the transactional relationship and becoming experts on their clients and prospects. But why is this so crucial, and what benefits can it bring to your business?

The Importance Of Knowing Your Clients Inside And Out

Credit unions operate in a highly competitive and regulated environment. To stand out as a supplier, you need to demonstrate a deep understanding of their financial performance and the specific challenges they face. This knowledge allows you to provide tailored solutions that address their unique needs, setting your firm apart as a trusted advisor rather than just another vendor.

Whether it’s identifying growth opportunities, managing risks, or optimizing operational efficiency, they expect you to have insights that can guide their decision-making.

What Information Are Credit Unions Looking For?

To truly differentiate your firm, you need to be well-versed in several key areas:

- Industry Trends And Benchmarking: Credit unions expect you to provide context around their performance by comparing it to industry standards and peer institutions. This includes understanding local, regional, and national trends that may impact their operations.

- Financial Performance Analysis: Your clients rely on you to interpret their financial data, identify potential risks, and highlight opportunities for growth. This requires a deep understanding of financial statements and key performance indicators.

- Strategic Insights: Beyond the numbers, credit unions seek guidance on how to align their operations with their long-term goals. This could involve advising on product offerings, market expansion strategies, or technology investments that will drive future success.

“As a former credit union CFO and CPA firm audit partner, I’ve experienced the advantage of using Peer Suite in the audit planning process.

The insightful financial performance nuggets gleaned from the platform not only enable a more risk-based audit approach, but importantly enable the audit staff to conduct meaningful conversations with credit union clients, often resulting in the cross sale of various consulting services.

I can’t imagine conducting an audit or consulting engagement without the knowledge gained from Peer Suite. If you’re not using it – you’re missing out.”

The Outcomes Of Becoming A Trusted Advisor

When you position yourself as an expert on your clients and prospects, the benefits extend far beyond the immediate transaction:

- Differentiation In The Market: By providing tailored, data-driven insights, you set your firm apart from competitors who may only offer generic solutions. This differentiation can be a key factor in winning new business and retaining existing clients.

- Stronger Client Relationships: Clients who view you as a trusted advisor are more likely to engage in long-term partnerships. This trust fosters deeper relationships, leading to more collaborative and productive interactions.

- Increased Business Opportunities: Understanding your clients’ needs opens the door to cross-selling opportunities. When you can anticipate and address their challenges proactively, you position your firm to offer additional products and services that support their goals.

How Callahan Helps Credit Union Suppliers

For over 40 years, Callahan & Associates has helped credit unions and their suppliers leverage data to achieve long-term success. We understand the importance of becoming an expert on your clients and are here to help you do the same.

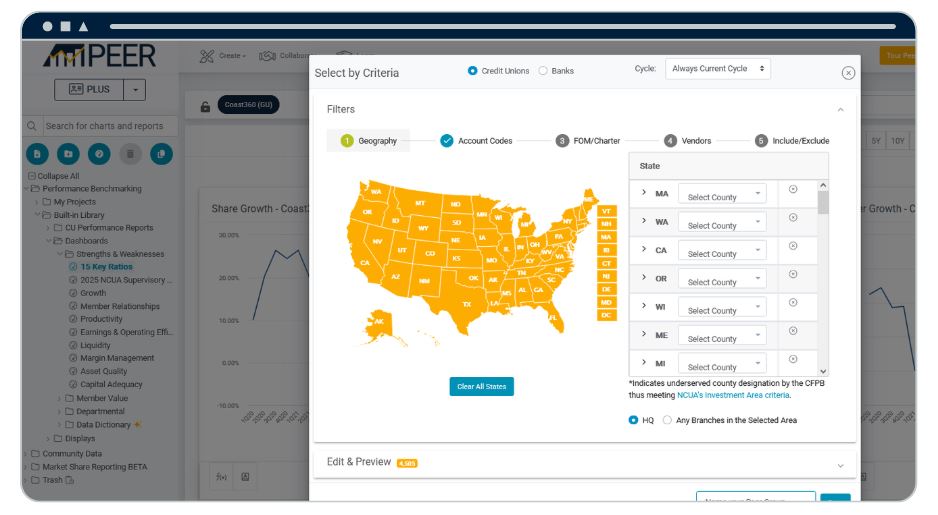

Our peer-based analysis tool, Peer Suite, offers instant access to industry call reports, performance analysis, and strategic insights that can transform the way you engage with your clients. Let us show you how to use these tools to differentiate your firm, build stronger relationships, and grow your business.

Start the conversation with our team where we’ll walk you through our tools and even export a few performance packets for you to use in your next client meeting—at no cost.