While benchmarking your performance against asset-based peer groups has value, relying strictly on asset size for peer group analysis can skew your benchmarks by including credit unions that don’t share much in common with your institution.

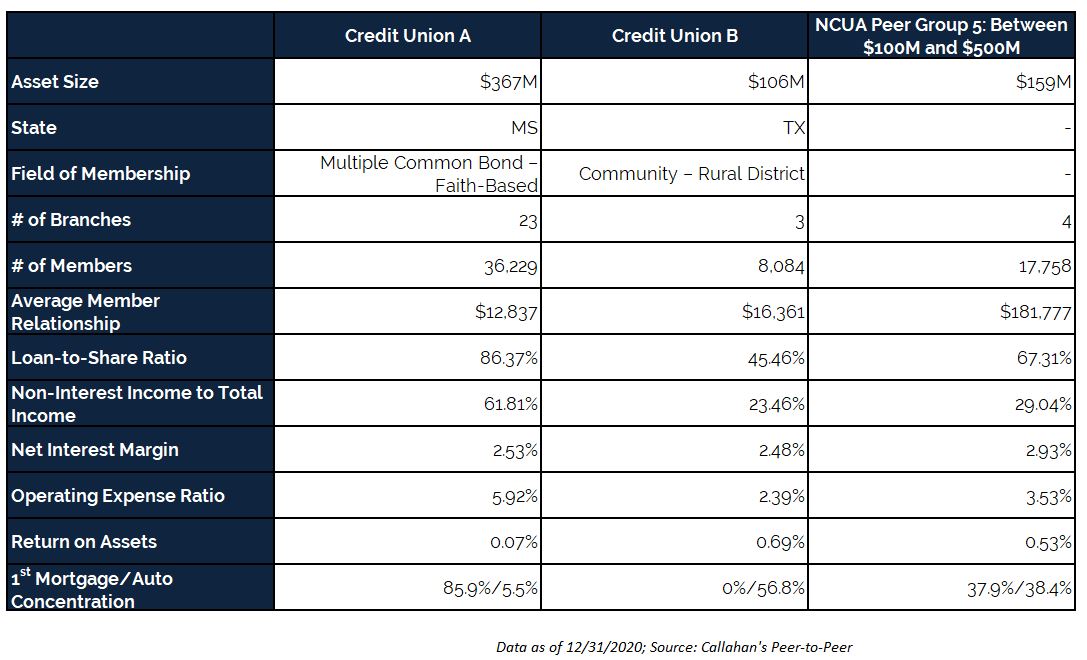

Just take a look at this actual example of two credit unions within the same NCUA-designated peer group:

As the table shows, these credit unions are not an ideal comparison for each other even though they are included in and impact the numbers of the same peer group. For more accurate benchmarks against which to measure your credit union’s performance, try using the criteria below in addition to asset size.

Three Peer Group Ideas That Go Beyond Asset Size

Business Model

Credit union financials and operations can differ greatly based on the business model. For instance, non-interest income makes up 61% of credit union A’s total income while it comprises less than 25% of the total income of Credit Union B’s. This not only signifies a difference in how these credit unions generate revenue but also impacts key financial performance ratios like net interest margin and ROA

Loan Concentration

Loan concentration and production show where a credit union’s lending activities are most active and how it generates loan interest income. For example, Credit Union A’s loan composition is made up of 85.9% 1st mortgage loans while Credit Union B does not offer mortgage products and more than 56% of its loans are for new and used autos. Loan mixtures and concentration data help show an institution’s business focus and internal goals, letting you create peer groups of credit unions that are similar to yours in terms of strategy and operations.

Geography

Market dynamics, economic situations, and competition levels differ among geographic regions, states, and even counties. Considering geography is vital as location often impacts members’ demand for financial products, financial capacity, and lives in general. Members in Mississippi may have a different set of wants and needs than those in Texas.

Benchmark Your Credit Union’s Performance

Callahan’s data and analytics tools, Peer-to-Peer and CUAnalyzer, make it easy to build custom peer groups using the data and strategies listed above and more. With hundreds of pre-built formulas, graphs, and tables it’s easy to compare your credit union directly to relevant credit unions and banks.

Callahan clients can log in to the Callahan Portal to access their data and anlalytics tools.

Don’t have access? Click here to request a custom scorecard and we’ll show you how easy it is to build comparisons in Peer-to-Peer.

More Blogs

Browse 5300 Call Reports With Ease.

Every CU 5300 Call Report – Instantly And Seamlessly. If your goal is to reach more credit unions with your products and services, you likely know all too well how long it takes to pull 5300 Call Reports for dozens of prospects to fuel your sales pipeline and...

How Sales Teams Work More Efficiently In Peer Suite

Is your team spending countless hours manually pulling reports and compiling data for your credit union prospects? Are you looking for a more efficient way to collaborate with your team and onboard new members? Callahan’s Peer Suite helps credit union suppliers...

Ultimate Benchmarking Guide For Credit Unions

What Is Benchmarking? Benchmarking is the interpretation and analysis of financial information in order to make direct performance comparisons to other credit unions, banks, and customized peer groups. It enables a credit union to track internal goals, identify...

How Interra Is Advancing Its Purpose Journey

Several years ago, the five-member executive team of Interra Credit Union ($1.7B, Goshen, IN) participated in a virtual learning experience from Callahan & Associates offered in collaboration with Harvard Business School Online.

3 Peer Group Types That Go Beyond Asset Size

While benchmarking your performance against asset-based peer groups has value, relying strictly on asset size for peer group analysis can skew your benchmarks by including credit unions that don’t share much in common with your institution. Just take a look at this...

How To Address Board Concerns On Performance

Navigating Tough Questions: How to Address Board Members' Concerns about Financial Performance As a credit union leader, you understand that one of your most important responsibilities is to articulate your credit union's financial performance to the board of...

CECL: Everything You Need To Know

CECL: Everything You Need To Know In 2016, the Financial Accounting Standards Board announced that they would change the methods financial institutions used to calculate and report charge-offs. This new regulation changed the method from an Allowance for Loan and...

4 Most Commonly Confused Call Report Codes

Callahan's Tips For Correctly Reporting To The NCUA The NCUA’s 1Q22 5300 Call Report contained over 1,000 new, erased, and changed codes, leaving many credit unions in the dark on how to correctly report quarterly. As credit unions familiarize themselves with the...

Peer Suite Access Levels For Suppliers

Callahan & Associates is getting ready to launch four access levels within the Peer Suite for suppliers. Find out which access level is right for you.

How BCU’s Purpose-Driven Mindset Drives Growth

Key Results from Sustainable Business Strategy In the first quarter of 2022, a dozen BCU ($5.4B, Vernon Hills, IL) team members participated in Sustainable Business Strategy, a virtual-learning experience offered by Callahan & Associates in collaboration...