Navigating Tough Questions:

How to Address Board Members’ Concerns about Financial Performance

As a credit union leader, you understand that one of your most important responsibilities is to articulate your credit union’s financial performance to the board of directors.

While this can be a relatively straightforward task when your credit union is performing well, it can be challenging to navigate tough questions when your financial performance is not meeting expectations.

Fortunately, with the right tools and strategies in place, you can effectively address questions and concerns from your board members.

Streamline Reporting With The Built-in Board/Governance Dashboard

Peer Suite’s performance-benchmarking features provide built-in dashboards that contain key performance indicators tailored for individual departments and board leaders at your organization.

These built-in dashboards are designed to give you a quick snapshot of your institution’s financial performance and identify areas where you may need to improve – all without lifting a finger.

Tell A Compelling Story With Comparison Sets That Go Beyond Asset Size

While comparative performance benchmarking against peers of similar asset sizes can provide valuable insights, it may not tell the complete story.

Credit unions face unique challenges and opportunities based on factors such as geographic location, field of membership, and business model. By creating custom peer groups based on criteria such as loan portfolio breakdowns or reliance on non-interest income, you can gain a more accurate understanding of your shop’s performance compared to other credit unions facing similar challenges and opportunities.

Peer Suite helps you quickly build a variety of peer groups to help you tell your performance story more easily . This approach can lead to more meaningful benchmarking, strategic conversations, and a clearer path to improving overall performance.

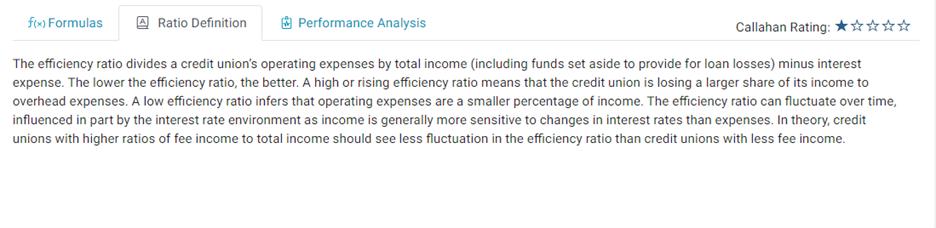

Interpret Display Metrics With Help From Ratio Definitions

It’s one thing to have all the metrics and performance indicators you need all in one place. It’s another thing entirely when you can understand how formula and account codes are used, and to see the benefits your can gain by tracking performance in order to answer difficult questions.

That’s why credit union leaders rely on Peer Suite’s built-in dashboards and ratio definitions.

This is particularly useful when you’re presenting financial performance data to board members who may not be familiar with financial jargon. By including definitions alongside the data, you can ensure everyone is on the same page when it comes to measuring the success of your institution.

Example Ratio Definition For Peer’s Efficiency Ratio Display

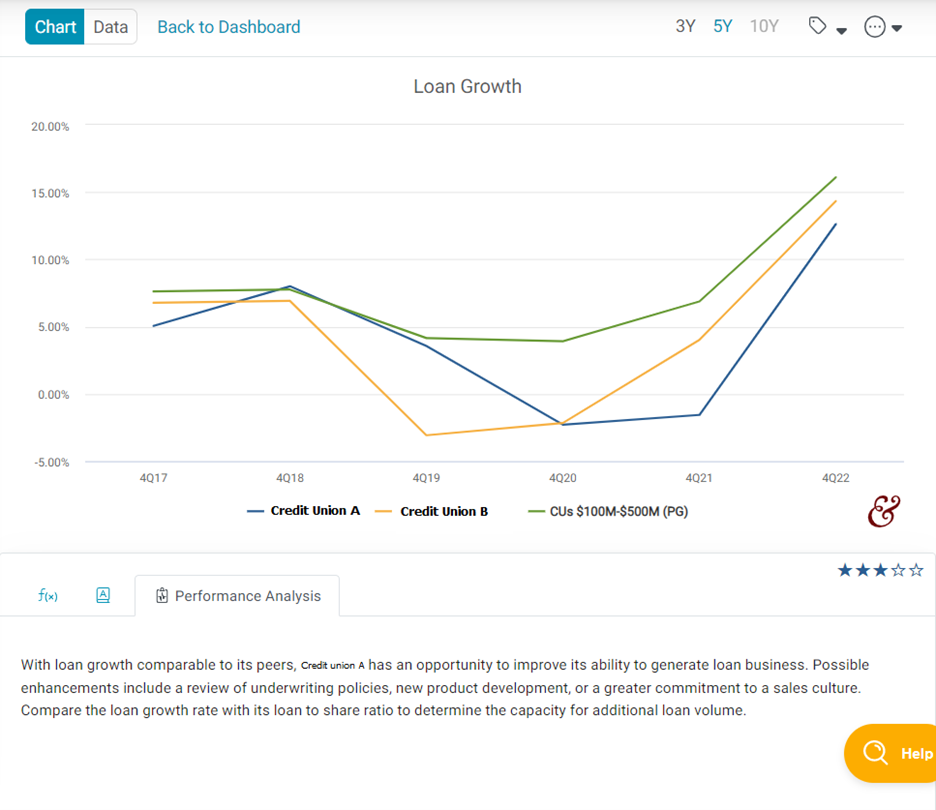

Performance Analysis From Our Data Experts

Finally, Peer Suite’s performance-benchmarking tool provides performance analysis from our data experts. Our team can help you identify areas where your credit union is under performing and provide recommendations for improvement.

This can be incredibly helpful when answering tough questions from board members who may be concerned about your credit union’s financial performance.

Navigating tough questions about financial performance can be challenging, but with the right tools and strategies in place, it can be done effectively.

Peer Suite‘s performance-benchmarking tool provides built-in dashboards, star rankings against comparison groups, definitions to better understand what a display measures, and performance analysis from our data experts, making it an invaluable tool for credit union executives. By leveraging these features, you can effectively articulate your credit union’s financial performance to the board of directors and address any concerns they may have.

Want to learn more about how your credit union could leverage Peer?

More Blogs

Credit Unions See Record High Member Engagement and Relationships In 4Q21

More consumers than ever turned to credit unions in 2021. Total industry assets surpassed $2 trillion last year, as over 5.4 million Americans became new credit union members bringing total membership to 131.1 million. Additionally, the industry is seeing accelerated...

This Month In Impact – January 2022

One of Callahan & Associates 2022 goals is to increase our Impact Network members and how we impact our community of credit union leaders. We’re devoting much of our content this year to talk about impact, including how credit unions are looking at impact,...

Top 5 Webinars Of 2021 On CreditUnions.com

Through all the ups and downs, twists and turns that 2021 put the credit union industry through, Callahan has continued empowering credit unions to impact their communities in meaningful ways. That includes our webinars, which offer key insights into a variety of...

Top 5 Articles Of 2021 On CreditUnions.com

It has been a lively year for the credit union industry. A year that started in the throes of COVID-19 has now given way to nationwide economic reopening tempered by labor shortages, inflation, and now, concerns about yet a new variant. Through it all,...

3 Themes For Credit Union CEOs Leading Into 2022

Credit unions have reported a string of significant milestones across 2021. Over the past few months, we've been able to speak with hundreds of credit leaders and wanted to share some of the key themes we’ve been hearing. Digital Transformation Digital transformation...

Alternative Data Sets And How They Can Help Your Credit Union

For credit unions, there’s no such thing as “too much data”. If there’s data that exists for credit unions to get a better gauge on their role in the local community or in the industry at large, it’s in the cooperative’s best interest to uncover it. While typical...

A Successful Launch Starts With A Successful Team

People often ask me why I’m such a passionate credit union advocate. OK, to be honest, the question is usually more along the lines of “why are you obsessed with credit unions”, and the “people” in question are my friends, family, neighbors, kids’ friends’ parents,...

Webinar Recap: How Callahan Quantifies Credit Union Impact

We recently hosted “Measure Your Mission: How To Quantify Credit Union Impact” as part of the quarterly Tableau User Group (TUG) engagement webinar. In it, we outlined the goals of Callahan’s impact initiative, how impact metrics are quantified, and what credit unions...

3 Ways To Use 2Q21 Data

The NCUA has officially released second quarter credit union data. Callahan provides your credit union a multitude of ways to analyze this updated data to benefit your cooperative. Here are three: 1. Build custom tables in Peer-to-Peer In Peer-to-Peer, credit unions...

Recapping The Impact Network Meet-Up

On August 17, dozens of credit unions joined Callahan & Associates for the first ever Impact Network Meet-Up. This event, which was open to Impact Network participants only, was created to help participating credit unions form connections, start impact-related...