Is your team spending countless hours manually pulling reports and compiling data for your credit union prospects? Are you looking for a more efficient way to collaborate with your team and onboard new members?

Callahan’s Peer Suite helps credit union suppliers streamline their workflows and collaborate more effectively so you can spend more time focusing on reaching organization goals.

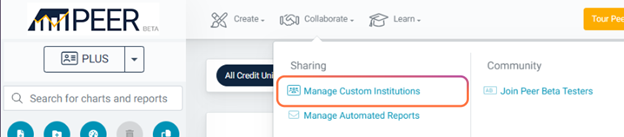

Streamline Your Sales Process With Shared Lead Lists

Whether you’re gathering leads for your team to pursue, transferring territories to someone else, or onboarding new leaders, Peer Suite makes sharing your creations with others easy.

The power is in your hands to grant view-only access or allow others permission to edit your custom lead lists, so you can shift your focus to other responsibilities and tasks.

Create And Share Folders The Whole Team Can Leverage

When looking at credit union performance to identify possible prospects or ways to position your messaging, are there a handful of metrics you tend to gravitate to?

Peer Suite makes it easy to collect, organize, and share key metrics you reference most frequently in custom folders. Reduce the need for redundant work and ensure your team has the right tools and metrics to be successful.

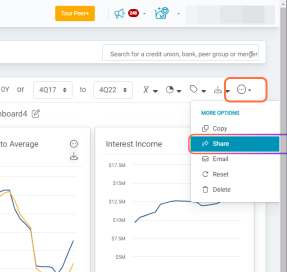

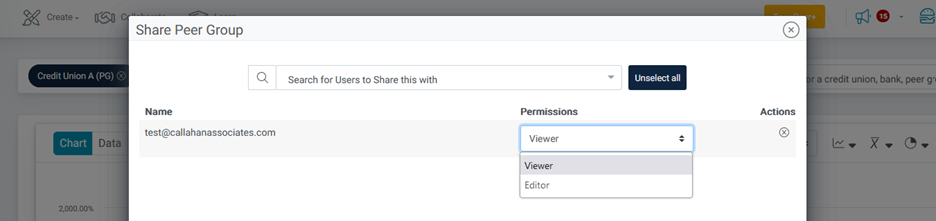

Manage Permissions And Foster Collaboration

Whether you’re looking to share a consistent playbook on the audience and metrics your team will need to be successful or collaborating on team initiatives, Peer Suite makes it easy to control how you share with others.

- Grant view-only access

- Grant editor permissions to allow others to modify and improve peer groups and content.

With Peer Suite, credit union supplier teams can collaborate more effectively, streamline their workflow, and win more deals.

Request a Peer Suite demo today and experience the benefits of streamlined collaboration and onboarding.

More Blogs

Credit Unions See Record High Member Engagement and Relationships In 4Q21

More consumers than ever turned to credit unions in 2021. Total industry assets surpassed $2 trillion last year, as over 5.4 million Americans became new credit union members bringing total membership to 131.1 million. Additionally, the industry is seeing accelerated...

This Month In Impact – January 2022

One of Callahan & Associates 2022 goals is to increase our Impact Network members and how we impact our community of credit union leaders. We’re devoting much of our content this year to talk about impact, including how credit unions are looking at impact,...

Top 5 Webinars Of 2021 On CreditUnions.com

Through all the ups and downs, twists and turns that 2021 put the credit union industry through, Callahan has continued empowering credit unions to impact their communities in meaningful ways. That includes our webinars, which offer key insights into a variety of...

Top 5 Articles Of 2021 On CreditUnions.com

It has been a lively year for the credit union industry. A year that started in the throes of COVID-19 has now given way to nationwide economic reopening tempered by labor shortages, inflation, and now, concerns about yet a new variant. Through it all,...

3 Themes For Credit Union CEOs Leading Into 2022

Credit unions have reported a string of significant milestones across 2021. Over the past few months, we've been able to speak with hundreds of credit leaders and wanted to share some of the key themes we’ve been hearing. Digital Transformation Digital transformation...

Alternative Data Sets And How They Can Help Your Credit Union

For credit unions, there’s no such thing as “too much data”. If there’s data that exists for credit unions to get a better gauge on their role in the local community or in the industry at large, it’s in the cooperative’s best interest to uncover it. While typical...

A Successful Launch Starts With A Successful Team

People often ask me why I’m such a passionate credit union advocate. OK, to be honest, the question is usually more along the lines of “why are you obsessed with credit unions”, and the “people” in question are my friends, family, neighbors, kids’ friends’ parents,...

Webinar Recap: How Callahan Quantifies Credit Union Impact

We recently hosted “Measure Your Mission: How To Quantify Credit Union Impact” as part of the quarterly Tableau User Group (TUG) engagement webinar. In it, we outlined the goals of Callahan’s impact initiative, how impact metrics are quantified, and what credit unions...

3 Ways To Use 2Q21 Data

The NCUA has officially released second quarter credit union data. Callahan provides your credit union a multitude of ways to analyze this updated data to benefit your cooperative. Here are three: 1. Build custom tables in Peer-to-Peer In Peer-to-Peer, credit unions...

Recapping The Impact Network Meet-Up

On August 17, dozens of credit unions joined Callahan & Associates for the first ever Impact Network Meet-Up. This event, which was open to Impact Network participants only, was created to help participating credit unions form connections, start impact-related...